Mastering Exness Copy Trading A Comprehensive Guide

Mastering Exness Copy Trading

Exness Copy Trading has become an essential tool for both novice and experienced traders who seek to optimize their trading performance effortlessly. By allowing individuals to replicate the trades of seasoned professionals, this innovative approach democratizes trading opportunities. For those looking to understand how to connect with Exness and leverage this feature effectively, a comprehensive guide is available at Exness Copy Trading https://naviosilva.pt/2025/04/17/comment-se-connecter-a-exness-la-methode-precise-6/.

What is Exness Copy Trading?

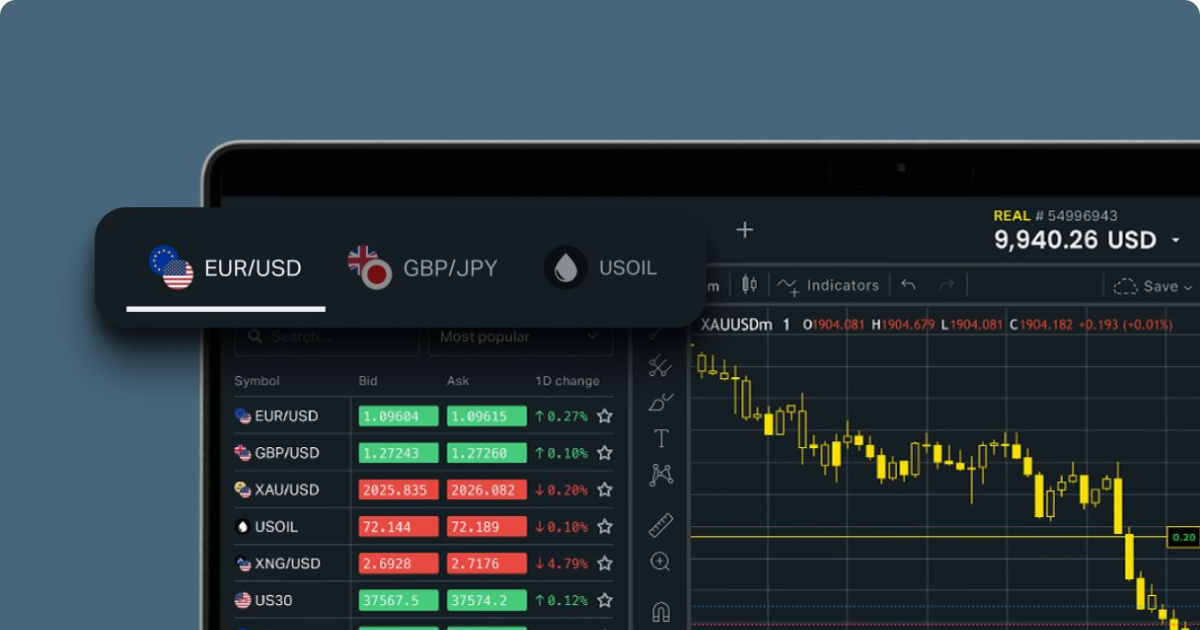

Exness, a well-established forex broker, offers a feature known as Copy Trading. This enables traders to automatically copy the trading strategies and positions of more experienced traders. Copy Trading is particularly attractive for those who lack the time or expertise to engage in individual trading actively. By selecting a trader with a reputable track record, users can mirror their trades in real time. As a result, they can potentially benefit from the expert’s skills while learning about trading practices.

How Does Copy Trading Work?

The mechanics of Exness Copy Trading are straightforward. Once a trader opens an account, they can browse through a list of top performance traders available on the platform. The selection criteria often include the trader’s success rate, risk profile, and trading style. Following the selection, users can allocate a portion of their funds to copy the chosen trader’s positions.

Once set up, the system automatically replicates the trader’s open positions proportionately based on the funds allocated by the user. For instance, if a trader risks 10% of their capital on a particular trade, the copy trading system will adjust accordingly based on how much the user has allocated.

Advantages of Exness Copy Trading

- Accessibility: Copy Trading breaks down the barriers for entry into trading by allowing individuals with limited knowledge to get on board.

- Learning Tool: By observing successful traders, newer traders can learn strategies and insights that they might not encounter in traditional learning settings.

- Diversification: Users have the ability to diversify their investment by copying multiple traders with various strategies, reducing risk.

- Time-saving: Traders can save time as the system allows them to follow and replicate others while attending to other commitments.

Choosing the Right Trader to Copy

Selecting the right trader is crucial to successful Copy Trading. Traders must consider various factors before choosing whom to replicate. First, evaluate the trader’s performance metrics, including their win rate and average return on investment. Additionally, understanding their trading strategies, whether they prefer high-frequency trading or long-term strategies, can help users align their risk tolerance and investment goals. It’s also beneficial to assess the trader’s level of risk, as higher returns can come with higher volatility.

Setting Up Your Exness Account for Copy Trading

To get started with Exness Copy Trading, users must first create a trading account with Exness. The registration process is user-friendly, and once the account is verified, users can fund their accounts. Following funding, accessing the Copy Trading feature is a matter of navigating to the designated section on the Exness platform. Users can then browse through the available traders and make informed decisions based on their preferences.

Managing Your Copy Trading Portfolio

Once users have selected traders to copy, managing the portfolio becomes essential. Regularly reviewing performance and making adjustments based on market conditions or changes in trading strategy can help maintain an optimal portfolio. Users can increase or decrease their allocated funds to particular traders to reflect confidence in their strategies. Moreover, regularly assessing the performance indicators of the copied traders and diversifying with different traders can help mitigate potential losses.

Risks Involved in Copy Trading

While Exness Copy Trading offers many advantages, it is important to be aware of potential risks. The most significant is that past performance is not indicative of future results. Even a trader with an exceptional track record can experience downtrends. Hence, it is vital to exercise caution and to only invest what one can afford to lose. Additionally, the automated nature of copy trading means that users may not have full control over their funds at all times, which could lead to unexpected losses.

Conclusion

Exness Copy Trading presents an excellent opportunity for individuals seeking to navigate the financial markets with greater ease and efficiency. By allowing users to replicate the strategies of seasoned traders, it provides a pathway to potentially profitable trading while also serving as an educational resource. However, as with any form of trading, it is crucial to approach the practice with due diligence, robust risk management, and a clear understanding of one’s financial goals. Through careful selection of traders and active management of one’s portfolio, users can unlock the full potential of Exness Copy Trading and enhance their trading experience.